We’re the first fund in Israel to have ESG woven into our core processes and are committed to helping our portfolio companies do the same.

Impact & Sustainability is at the

core of everything we do

Impact and Sustainability is a mindset we strive to integrate into all our business decisions and operations.

Our innovative methodology allows us to lead our startups through their ESG journey.

The best entrepreneurs who are building the most successful companies are the ones considering society and our planet.

Purpose-driven tech innovation is key to providing solutions for fundamental challenges our world is facing.

We believe that values lead to value and purpose creates profit.

Our Vision

We believe that the best entrepreneurs who will build the most successful and profitable companies are the ones considering society and our planet. Technology has the potential to scale solutions for some of society’s biggest challenges in an exponential way, certainly facing a world affected by climate change and social inequalities.

As a leading venture fund, we aim to initiate, support and contribute to creating a world we all want to live in, while keeping our focus on investing in the best and most profitable companies.

Our Strategy

We pride ourselves in being able to offer guidance and hands-on support to our companies as they design and implement their own ESG and Impact strategies.

We believe that successful integration of ESG into companies should be done through the company product and business in an authentic way, becoming part of the company’s identity. The outcome will be more inclusive, impactful, and profitable companies.

We include the following factors in our definition of Impact & Sustainability

Environment

Social

Governance

Impact

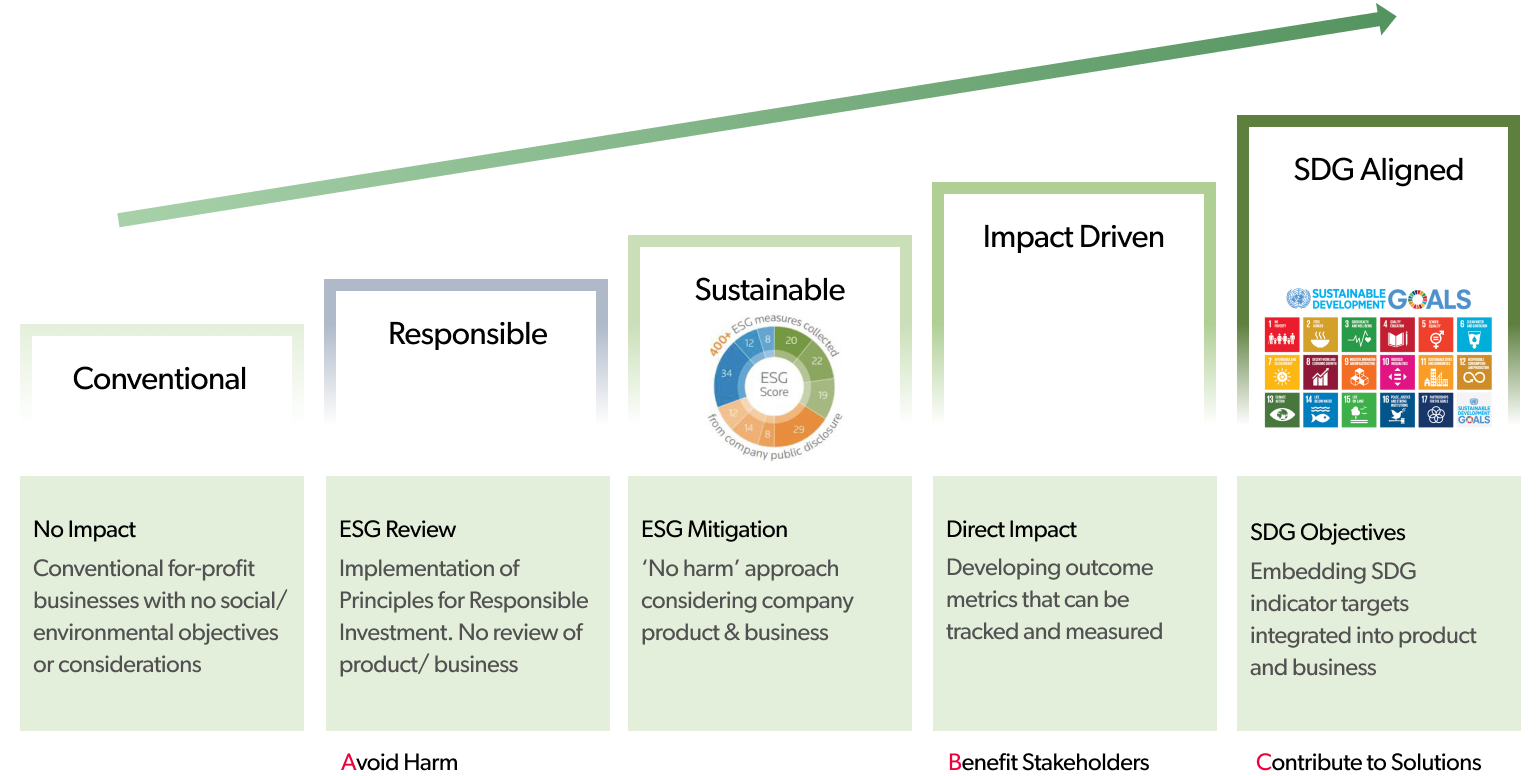

Our Methodology: The ESG to SDG Continuum

Our innovative methodology is the "ESG to SDG Continuum" based on the expectation that all companies should adopt the highest ESG standards, while companies able to address one or more of the SDGs should design and implement an Impact strategy. Impact is the outcome-based view of products and business models employed by the companies. We utilize the IMP methodology of ABC - Avoid harm, Benefit Stakeholders and Contribute to solutions and apply the Principles of Responsible Investment (PRI).

Our Commitment

By implementing ESG practices, we aim to create value for our portfolio companies, improve their responsible performance and manage risk. We are learning and guiding our companies through the complex regulatory environment currently evolving in the European and US markets.

The global hi-tech ecosystem is by far not diverse enough. Being aware of that, we take responsibility toward diversifying our ecosystem both from the investors side as well as the startups. In practice, we support the introduction of more women and people from diverse backgrounds into VCs.

Countless research evidence shows that diversity works for companies and leads to greater business success. We strongly believe that by applying these standards, our portfolio companies will be more successful financially and deliver superior returns, alongside providing high and measurable impact to society and our planet.